Kenya secures Sh193 billion loan to cut borrowing costs, boost stability

According to the Treasury, clearing the earlier debt avoids higher interest costs in the future and spreads repayments over a longer period, providing the government with more fiscal flexibility.

Kenya has successfully raised $1.5 billion (Sh193.8 billion) from international investors in a move aimed at lowering borrowing costs, easing pressure on taxpayers, and shielding the economy from sudden shocks.

The National Treasury said the funds were secured through two loans, a seven-year facility at 7.875 per cent interest and a 12-year loan at 8.8 per cent, giving the country an average borrowing cost of 8.7 per cent, one percentage point below earlier estimates.

More To Read

- Civic group petitions Senate over 'runaway graft'

- Africa’s 2030 electrification mission surges, connecting 30 million in first year

- Congestions, delays push Mombasa Port to position 375 of 403 worldwide- World Bank

- MPs demand clear plan as Treasury delays Sh864 million payments to media houses

- IMF says elections, climate shocks threaten Tanzania’s economic gains

- Court orders equal pay for UHC nurses amid absorption plan

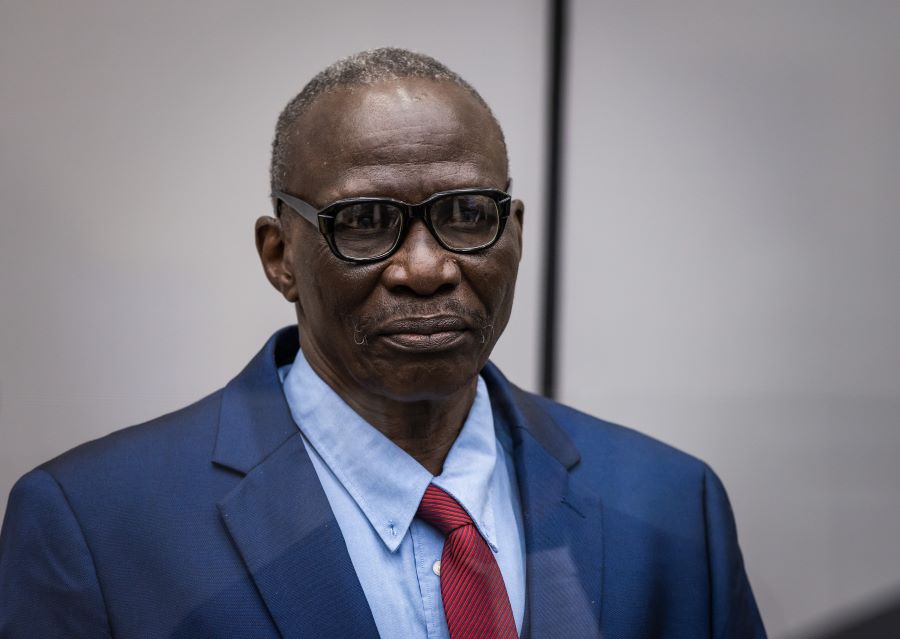

“This transaction shows the Government’s firm commitment to managing debt more wisely, paying off loans on time, and protecting Kenyans from sudden repayment shocks,” said Treasury Principal Secretary Chris Kiptoo in a statement on Friday.

Part of the new funds has already been used to retire $1 billion (Sh129 billion) of Kenya’s 2028 Eurobond ahead of schedule.

According to the Treasury, clearing the earlier debt avoids higher interest costs in the future and spreads repayments over a longer period, providing the government with more fiscal flexibility.

“By securing this deal, the Government has also smoothened and lengthened loan repayments, giving Kenya more breathing space in managing its finances,” Kiptoo added.

The move attracted strong interest from global investors. Though the government sought $1.5 billion, offers from international lenders exceeded $7.5 billion, five times the amount requested.

Most support came from fund managers in the United States (US) and the United Kingdom (UK).

“The strong response shows renewed confidence in Kenya’s economy,” PS Kiptoo said, noting that borrowing at slightly lower rates signals Kenya’s credibility to lenders.

The Treasury also highlighted that the funds will help stabilise the economy while allowing investment in priority areas such as roads, healthcare, and education.

“This success means Kenya will spend less on interest, ease pressure on taxpayers, and keep the economy stable while creating room to fund development priorities such as roads, health, and education,” Dr Kiptoo said.

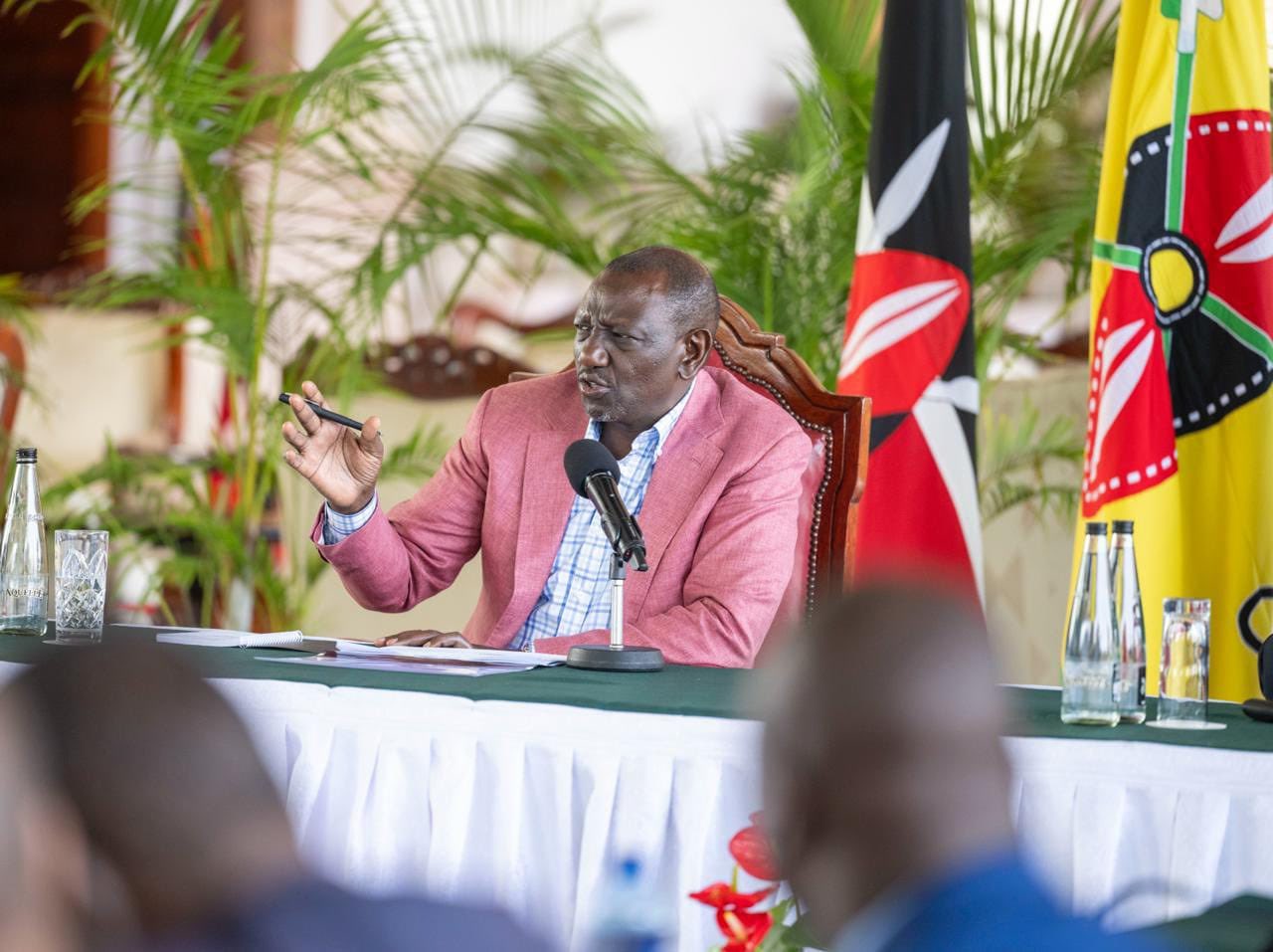

This latest debt management exercise is the third of its kind since 2024 and forms part of President William Ruto’s strategy to restructure Kenya’s debt, reducing risks associated with large repayments falling due at the same time.

Top Stories Today